Where To File Your New Zealand Tax Return Online

If you have worked in New Zealand, you will have noticed some income tax deducted in your payslip.

Well, did you know you can claim some of that income tax back? Of course, you did! That’s why you’re here! In this step-by-step guide, we’ll show you how to file a tax return in New Zealand!

The Inland Revenue Department (IRD) allows you to file your own tax return in New Zealand by setting up a “MyIR” account on the IRD website.

We recommend filing all the correct IRD paperwork before each waged job you undertake in New Zealand, and set up a MyIR account before the end of the tax year (begins on 1-April and ends on 31-March) so you can keep track of when you are able to file a tax refund through the IRD website.

However, if you miss the opportunity to file a tax return in New Zealand, there are other options to get your tax return which we mention at the bottom of this guide.

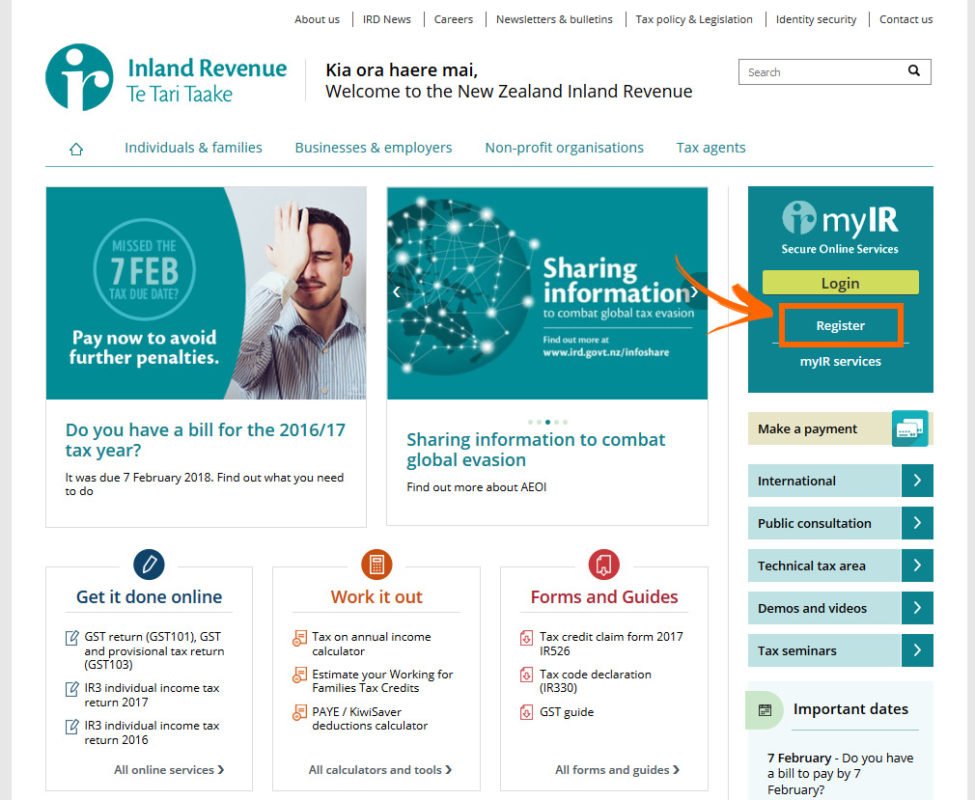

1. Register For A MyIR Account

To file for a tax return online, first, you need to register for a MyIR Account. Click on “Register” on the IRD homepage.

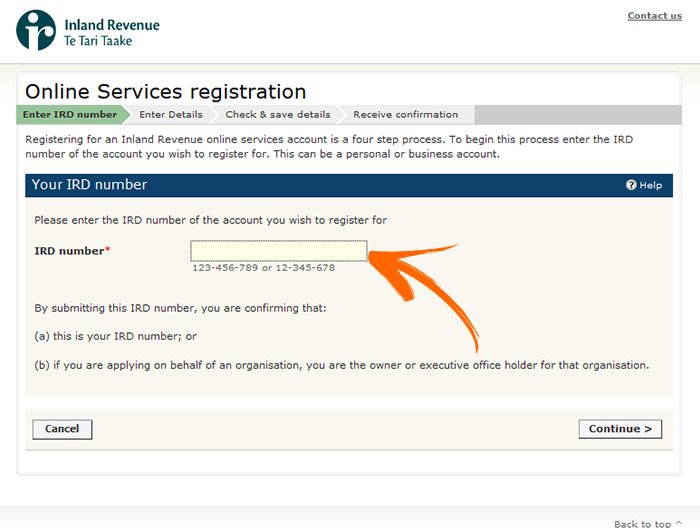

2. Enter Your IRD Number

Your IRD number is your tax number. You can find it on any payslips you have received from work or from any paperwork, emails, text messages you will have received from IRD. Type in your IRD number, – included, and click on “Continue”.

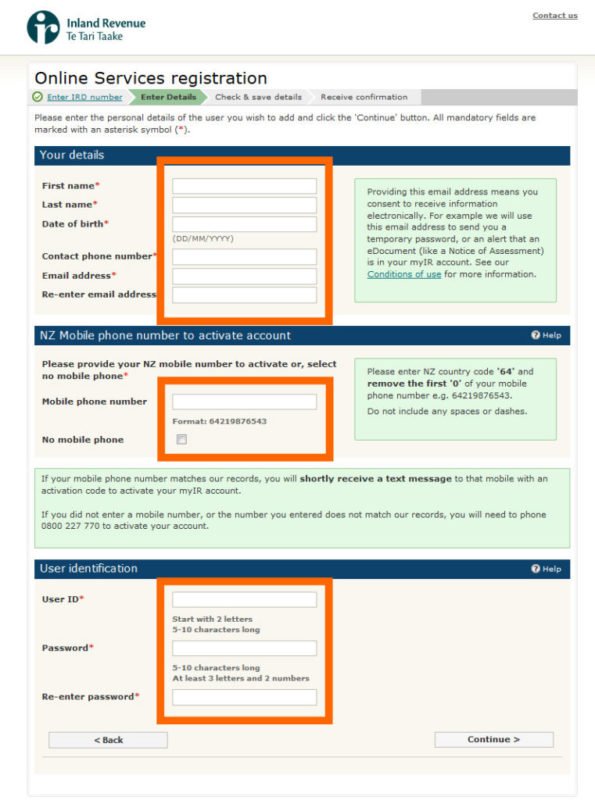

3. Fill In Your Details

It is mandatory to fill in all the fields on this page in order to proceed. Most importantly, you will need to enter a New Zealand phone number to activate your account. Numbers must be presented with a 64 instead of the first 0 of your phone number. For example, 642732737327 if your phone number was 02732737327. You’ll also need to choose a user ID and password.

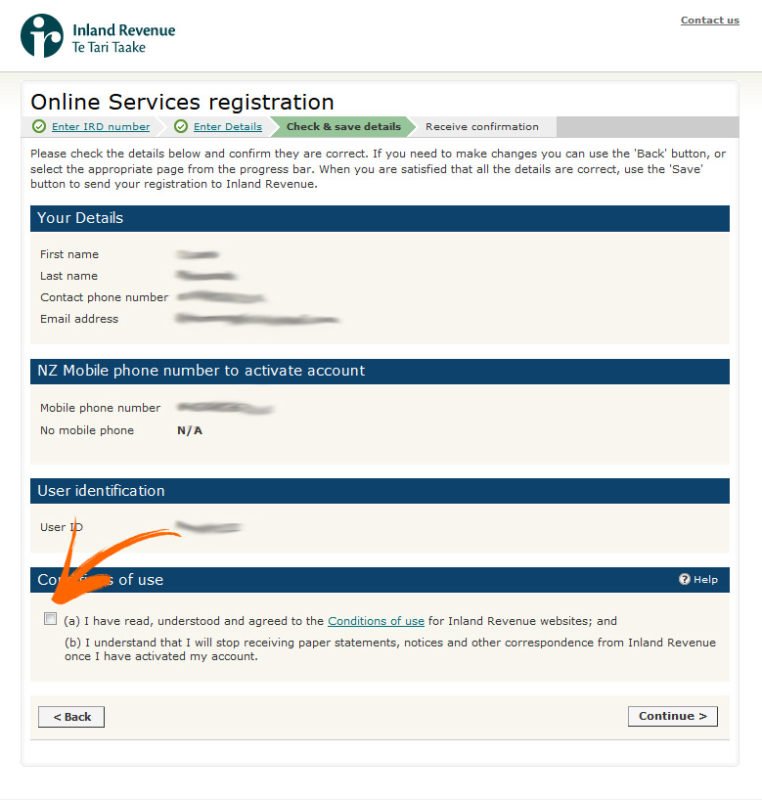

4. Agree To The Conditions Of Use

Check your details, click on the box to agree to the conditions of use, and continue.

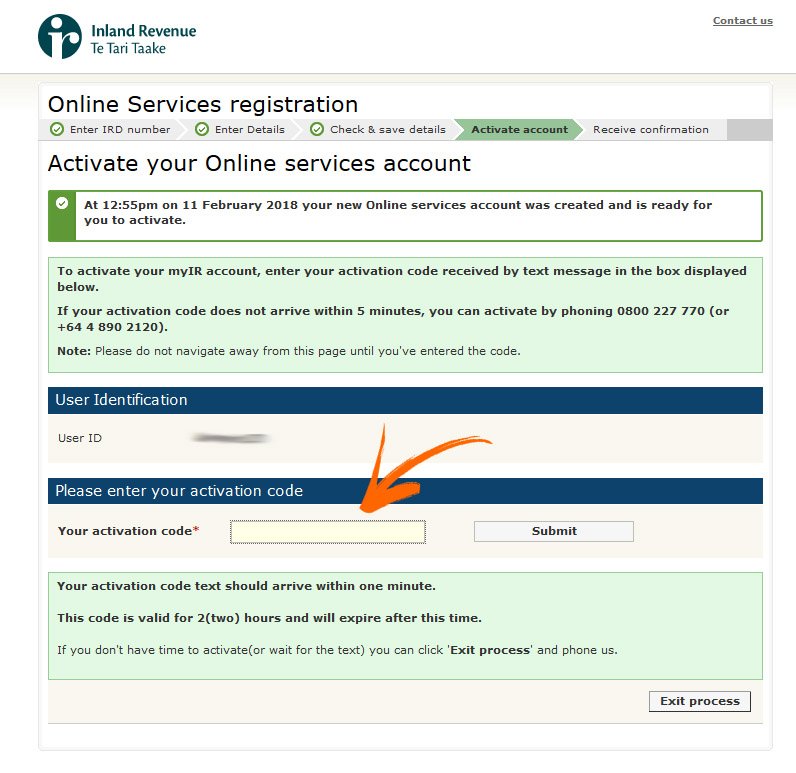

5. Use Your Activation Code

Once the previous page is complete, you will then receive an activation code by text. You have two hours to enter the activation code. Otherwise, click on end process and call IRD for an activation code. Enter the activation code and click “submit”.

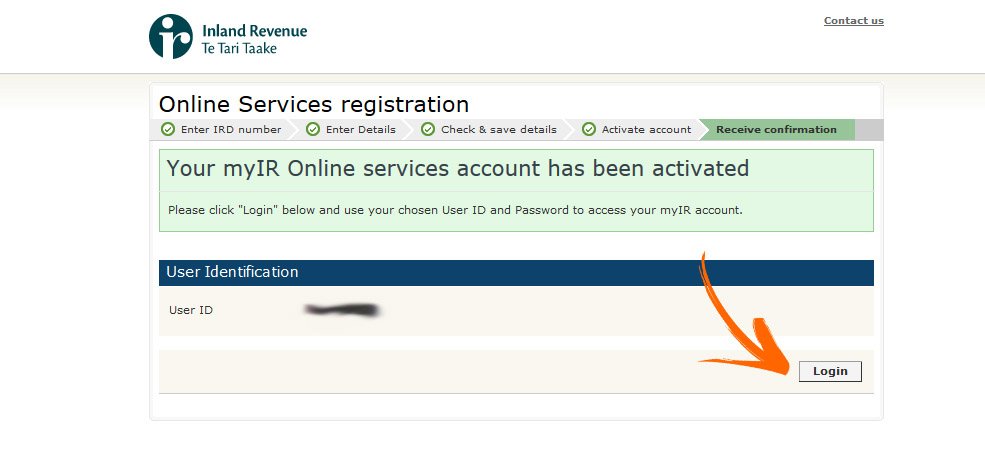

6. Login

If your activation code is successful, then you should see this page. Click “login”.

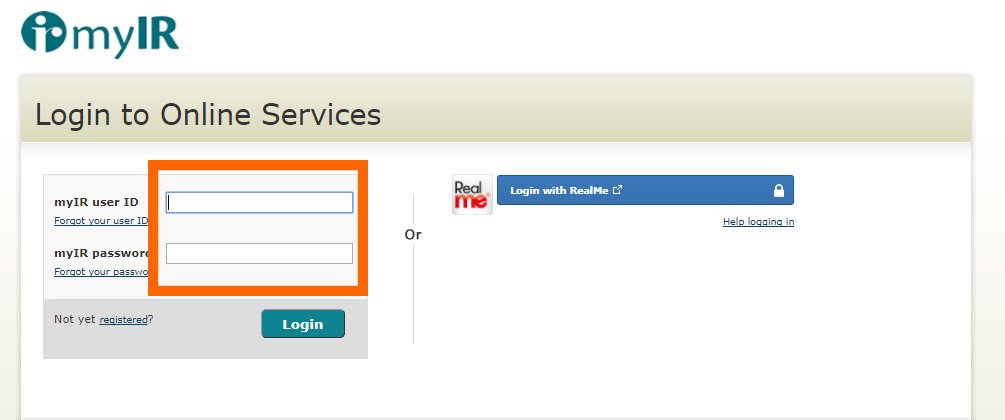

7. Log Into MyIR

Type in your User ID and password that you created in the previous steps and click “login”.

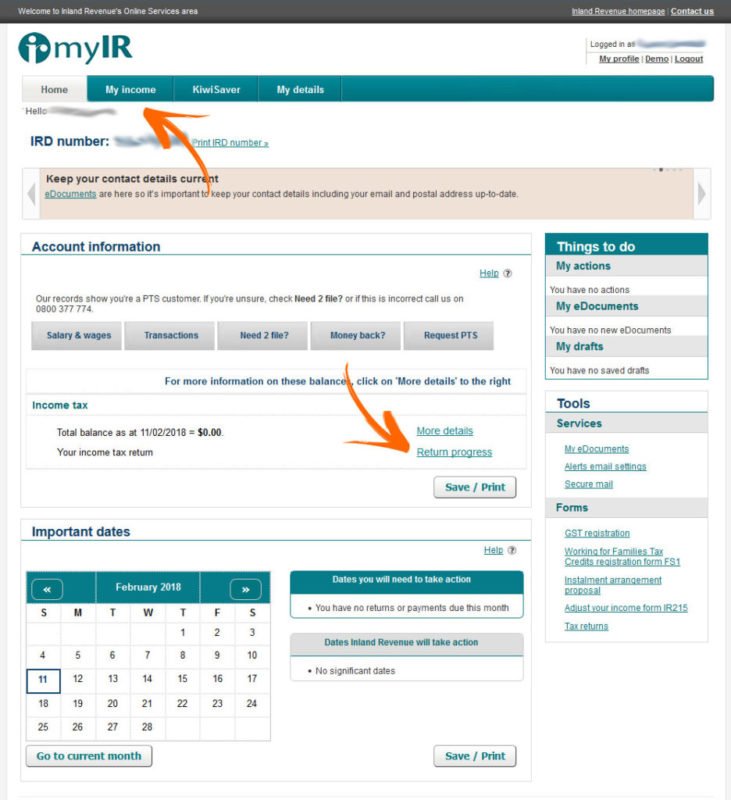

8. MyIR Homepage

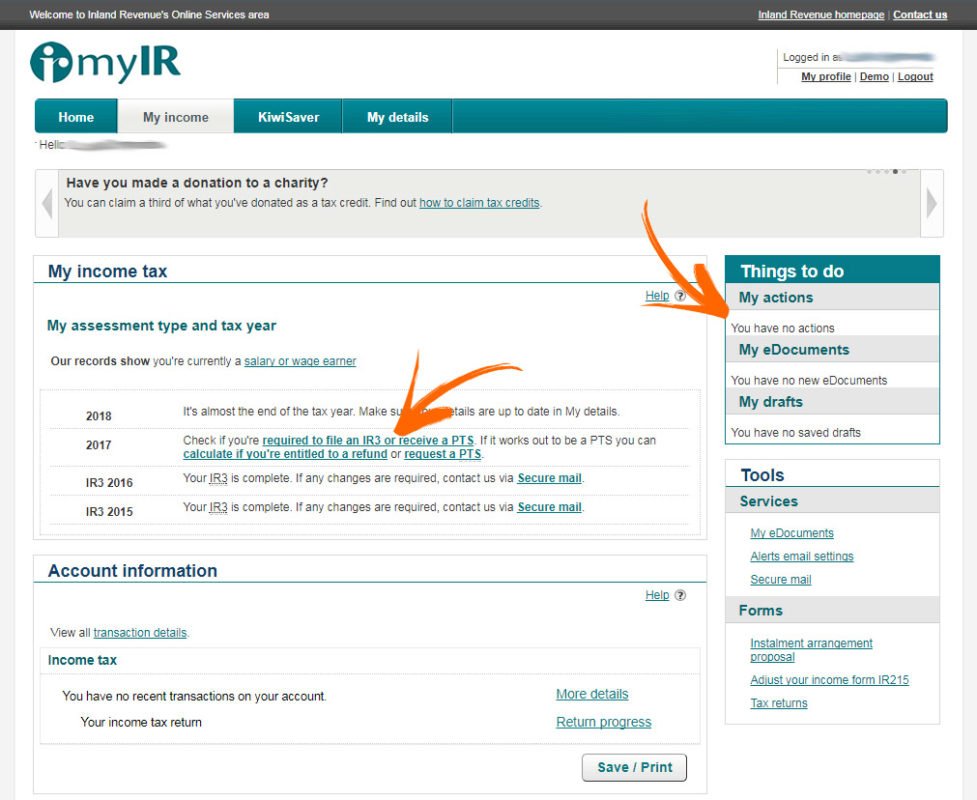

After you have logged in using your newly created User ID and password, you will see a page that looks like the screenshot below. Click on “Return Progress” or “My Income”.

9. Check If You Can File For A Tax Return

Under “Things to do” you may have a link to file for an IR3 (a tax return form) soon after the end of the tax year. Click on this link and you’ll go straight to the IR3 form which is straightforward to fill out. Otherwise, if the tax year has already been and gone, click on the links to “required to file an IR3 or receive a PTS” or ” calculate if you’re entitled to a refund” (both will take you to the same place).

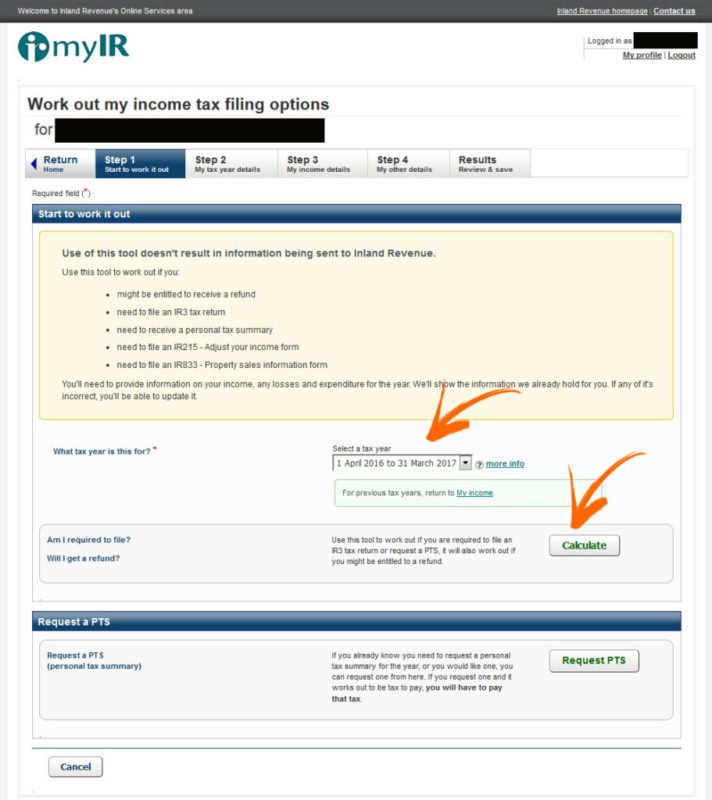

10. Complete Step 1 In The “Work Out My Income Tax Filing Options”

This tool will allow you to work out if you are entitled to a tax return in New Zealand. Select the year that you worked in New Zealand and click on “Calculate”.

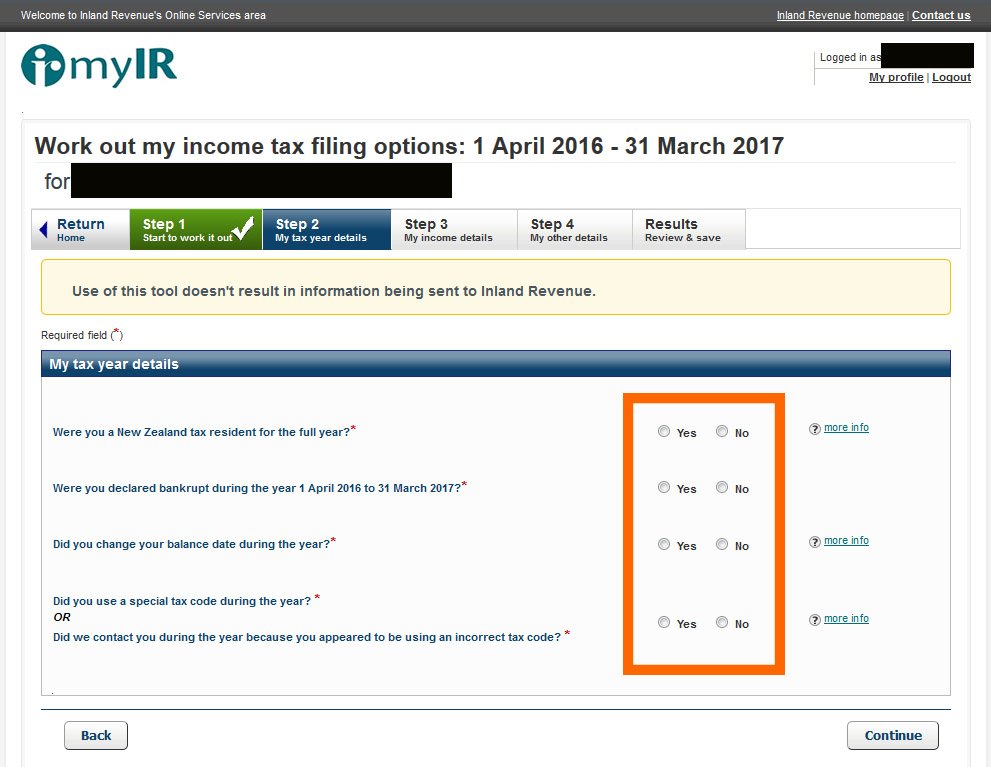

11. Complete Step 2

The next step is an easy “yes or no” form with some helpful information if you click on the “?” next to any question you are unsure about. If you used “M” as your tax code for all your jobs that tax year, then click on “no” for this question.

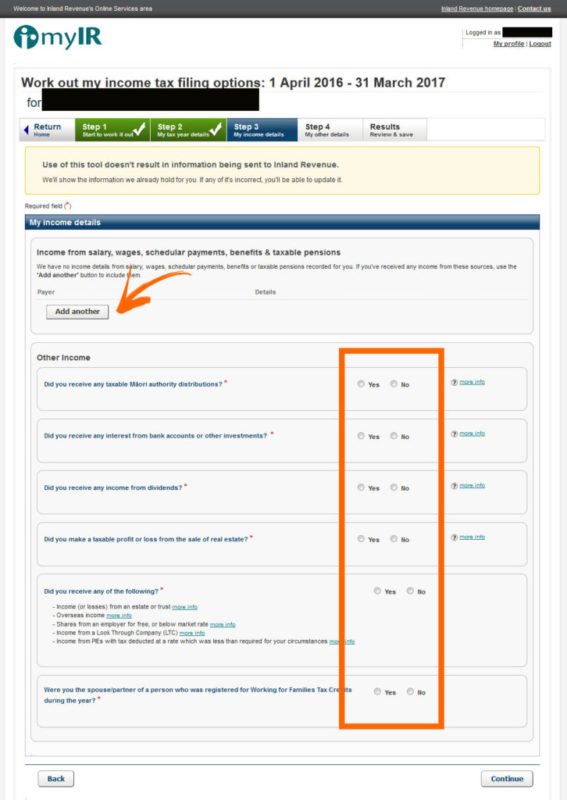

12. Complete Step 3

If you have completed the IRD paperwork before starting a job in New Zealand, for instance, Tax code declaration (IR330), then a record of this job will appear on this page. If a job where you have earned a wage does not appear here, then you have the option to add it manually by clicking “Add another”. Then complete the “yes and no” questions and click continue.

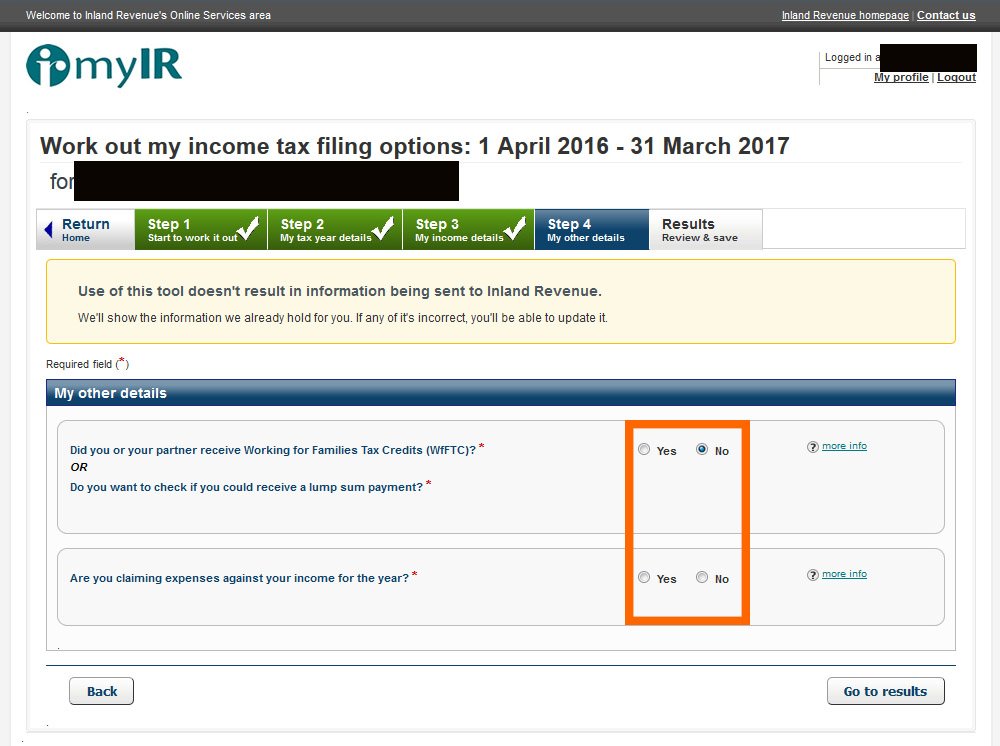

13. Complete Step 4

Answer the yes or no questions.

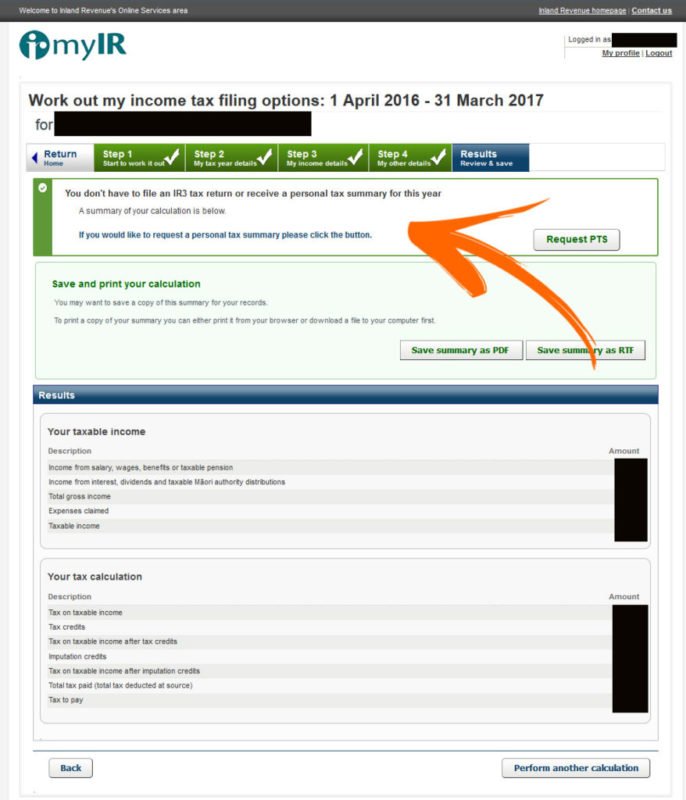

14. View Your Results & File Your IR3

In your result, you will be able to move onto the next process detailed in the green box. If you are eligible to file a tax return, your results will include a link to an IR3 tax return form. Complete the IR3 form and your tax refund should be in your bank account within 10 weeks (although it’s usually around two weeks). However, if you are not eligible, you will see a result similar to the one pictured below.

What To Do If You Believe You Are Eligible For A Tax Refund But Can’t Access An IR3 Form For The Tax Year

The best thing to do is to contact IRD directly. On your MyIR account, click on “Secure Mail” under the Tools tab to send a message to IRD. Alternatively, you can contact them with the following details:

- +64 3 951 2020 from overseas

- 0800 227 774 in New Zealand

- You can get a nominated person to contact IRD on 0800 227 774 by sending IRD a completed Elect someone to act on your behalf form (IR 597).

Source: NZ Pocket Guide

If you need these services here is our company details which provide.

Contact us:

Phone: 021 022 714 91

Email: office@accounts4all.co.nz

Website: https://accounts4all.co.nz

Address: 29 Cheval Drive, Totara Vale, Auckland, New Zealand

Linkedin: https://www.linkedin.com/company/accounts4allnz/